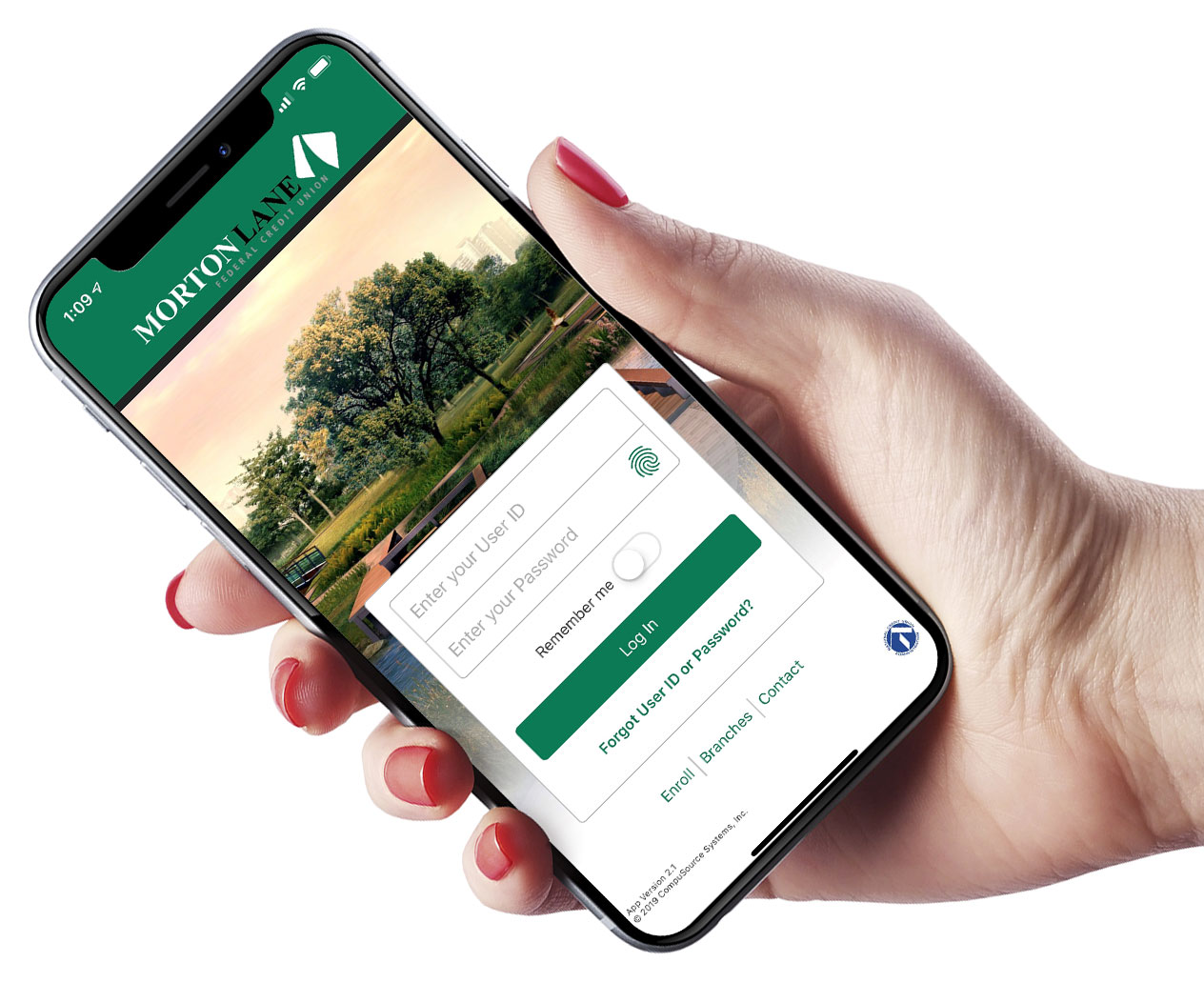

Download Our App

Download the FREE Morton Lane Federal Credit Union Mobile Banking App for iPhone or Android and easily access your accounts from your mobile device. Check your balances, history, funds, make deposits, pay bills and more. It's safe, convenient, and available wherever you are.

Mobile App Features

Quick View

View your accounts in seconds after logging in to our secure server.

Bill Pay

Receive and pay your bills electronically all in one place and all from your smart phone.

Find a Branch

Find one of our branches and get directions to us within seconds with our find a branch feature.

Mobile Deposits

Save time and deposit checks on the go with your smart phone.